Checking Out Why Partnering With a Home Mortgage Broker Can Substantially Simplify Your Home Getting Experience

Navigating the complexities of the home acquiring process can be complicated, yet partnering with a mortgage broker uses a strategic benefit that can streamline this experience. By serving as middlemans in between you and a broad selection of loan providers, brokers supply access to tailored financing options and skilled understandings that can reduce prospective barriers. Their proficiency not only improves effectiveness yet also promotes a much more tailored approach to protecting positive terms. As we discover the numerous facets of this partnership, one might question how these benefits materialize in real-world circumstances and influence your total journey.

Understanding Home Mortgage Brokers

These professionals possess comprehensive knowledge of the home loan market and its laws, allowing them to navigate the intricacies of the borrowing procedure successfully. They aid consumers in collecting necessary documentation, completing finance applications, and guaranteeing that all needs are fulfilled for a smooth authorization procedure. By negotiating terms in behalf of the customer, home loan brokers commonly function to safeguard desirable passion prices and problems.

Inevitably, the expertise and resources of mortgage brokers can significantly streamline the home buying experience, reducing some of the burdens generally related to safeguarding funding. Their function is vital in assisting debtors make notified decisions customized to their financial objectives and one-of-a-kind scenarios.

Benefits of Using a Broker

Utilizing a home mortgage broker can use many advantages for homebuyers and those seeking to refinance. One significant advantage is accessibility to a broader range of loan alternatives. Unlike banks that may just present their very own items, brokers collaborate with numerous loan providers, enabling customers to check out various mortgage remedies tailored to their specific economic situations.

In addition, home mortgage brokers have extensive industry expertise and proficiency. They stay informed about market fads, rate of interest, and lending institution needs, guaranteeing their clients get accurate and timely details. This can cause a lot more beneficial funding terms and potentially lower rate of interest.

Additionally, brokers can help recognize and resolve possible challenges early in the mortgage procedure. Their experience permits them to visualize challenges that might develop, such as credit rating problems or documentation needs, which can conserve clients time and stress.

Last but not least, functioning with a mortgage broker often brings about individualized service. Brokers typically invest time in understanding their customers' unique demands, leading to an extra personalized approach to the home-buying experience. This mix of access, expertise, and individualized service makes partnering with a mortgage broker a vital possession for any property buyer or refinancer.

Streamlined Application Process

The process of making an application for a mortgage can usually be overwhelming, yet partnering with a broker significantly streamlines it (Mortgage Broker Glendale CA). A home mortgage broker acts as an intermediary in between the borrower and the loan provider, enhancing the application procedure through professional advice and organization. They begin by analyzing your financial scenario, collecting needed records, and understanding your certain demands, ensuring that the application is tailored to your scenarios

Brokers are fluent in the intricacies of mortgage applications, assisting you prevent usual challenges. They offer clearness on needed documents, such as revenue confirmation, credit history records, and possession declarations, making it less complicated for you to collect and send these products. With their substantial experience, brokers can prepare for possible challenges and resolve them proactively, reducing aggravations and delays.

Accessibility to Numerous Lenders

Access to a varied selection of loan providers is just one go to this website of the key advantages of partnering with a home mortgage broker. Unlike traditional home getting approaches, where buyers are commonly read more restricted to one or two loan providers, home loan brokers have actually developed relationships with a vast array of banks. This substantial network permits brokers to existing clients with multiple funding alternatives customized to their unique demands and financial situations.

By having accessibility to numerous lenders, brokers can rapidly identify competitive rate of interest and positive terms that might not be available through direct channels. This not only improves the capacity for protecting a much more helpful home loan however likewise broadens the scope of available products, including specific finances for new customers, professionals, or those seeking to buy residential properties.

Additionally, this accessibility saves effort and time for homebuyers. Rather of speaking to numerous lenders separately, a home loan broker can streamline the process by gathering essential paperwork and submitting applications to several lending institutions all at once. This effectiveness can result in quicker authorization times and a smoother general experience, allowing buyers to concentrate on discovering their perfect home instead of browsing the complexities of home mortgage choices alone.

Personalized Support and Support

Browsing site here the home loan landscape can be overwhelming, however partnering with a mortgage broker supplies customized advice and support customized to every customer's certain needs. Home loan brokers act as middlemans, understanding specific financial scenarios, preferences, and long-lasting objectives. This personalized technique ensures that clients obtain guidance and remedies that align with their special circumstances.

A knowledgeable mortgage broker carries out thorough evaluations to recognize the most effective financing choices, taking into consideration factors such as credit report, earnings, and debt-to-income proportions. They additionally educate clients on different home mortgage items, helping them comprehend the ramifications of various rate of interest terms, prices, and fees. This knowledge empowers clients to make educated choices.

In addition, a mortgage broker provides continuous support throughout the entire home purchasing procedure. From pre-approval to closing, they assist in interaction in between lending institutions and customers, resolving any kind of worries that might occur. This constant assistance reduces stress and anxiety and conserves time, permitting customers to concentrate on locating their desire home.

Verdict

To conclude, partnering with a home mortgage broker supplies countless benefits that can dramatically boost the home getting experience. By supplying access to a broad range of car loan options, facilitating a structured application procedure, and using experienced assistance, brokers effectively mitigate obstacles and minimize tension for homebuyers. This specialist assistance not only boosts performance however also raises the probability of securing favorable funding terms, eventually adding to a much more successful and enjoyable home acquiring journey.

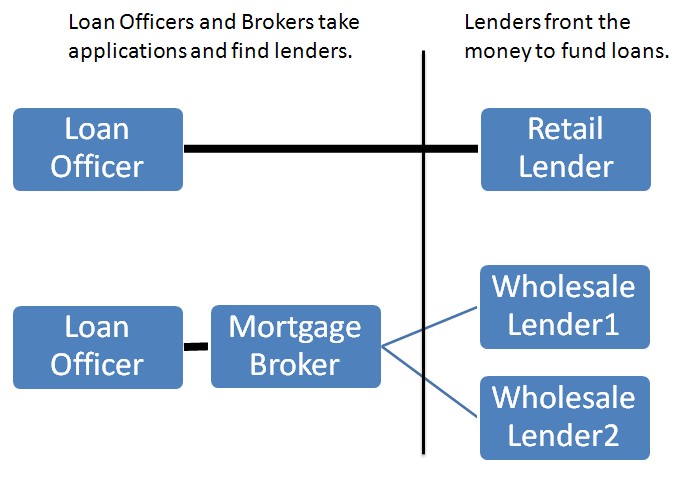

Browsing the complexities of the home acquiring process can be challenging, yet partnering with a home mortgage broker provides a strategic benefit that can enhance this experience.Home loan brokers offer as intermediaries in between lenders and consumers, helping with the loan process for those looking for to purchase a home or re-finance a present home loan. By simplifying the application, a mortgage broker enhances your home getting experience, allowing you to concentrate on finding your dream home.

Unlike typical home buying techniques, where customers are frequently restricted to one or 2 lenders, home loan brokers have actually developed relationships with a large array of monetary establishments - Mortgage Broker Glendale CA.Navigating the mortgage landscape can be overwhelming, yet partnering with a home mortgage broker provides customized support and assistance tailored to each client's certain demands

Comments on “Expert Mortgage Broker Glendale CA: Streamlining Your Home Funding Trip”